Dive Brief:

- J.P. Morgan studied how often Snapchat users engaged with advertisements on the platform and found the results to be underwhelming for any ad formats not native to the app, according to a new report in eMarketer.

- Sponsored geofilters and lenses, which are unique to Snapchat, topped the list, with 11% of respondents engaging "very frequently," 16% engaging "frequently" and 23% engaging "occasionally." However, 51% of respondents said they never engage those offerings at all. Swiping up on ads saw 73% never engaging, while watching video ads fared slightly better with 68% never engaging. Neither swiping up nor watching video ads cracked 10% engagement for the "very frequently" metric.

- Two separate studies cited by eMarketer from Kantar Millward Brown and Adweek suggest Snapchat's youth-centric user base is to blame for dismal engagement rates. The Kantar Millward Brown research found few young internet users like digital ads at all, and Adweek said around 28% of surveyed Gen Z and millennial users report they "hated" ads on Snapchat.

Dive Insight:

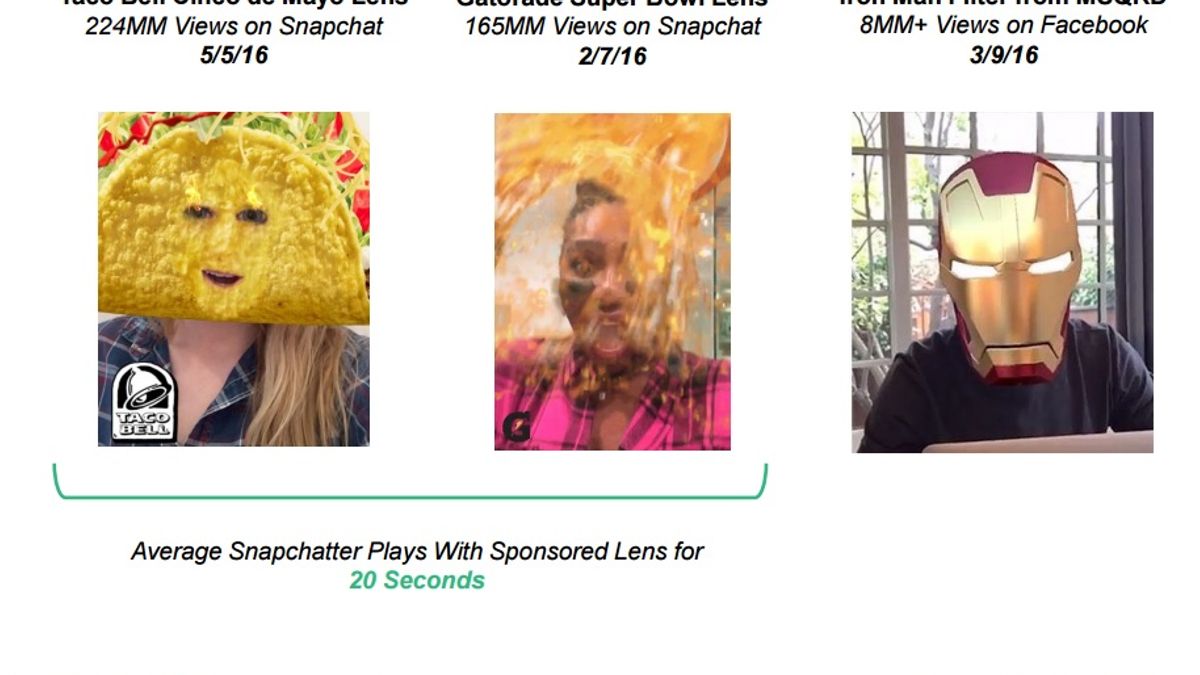

The good news for Snapchat: Its original ad offerings actually see a good deal of traction, which is perhaps unsurprising given that sponsored geofilters and lenses are the least "ad-like" formats on the platform, and are also pretty fun in leveraging the app's AR technology. These findings are important as Snapchat looks to stake out value and distinctness in an ever-more crowded social market.

The bad news is that pretty much everything else is fairing poorly, which hurts Snapchat's image coming off of parent company Snap's initial public offering of stock at the beginning of last month. Cathy Boyle, a principle analyst at eMarketer, noted in the report that sponsored geofilters and lenses, despite their success, are problematic in being both harder to scale and tougher to measure in terms of effectiveness compared to more traditional formats.

If Snapchat cannot figure out ways to scale its advertising, it might start to flounder. Analysts have already hammered Snapchat for its apparently stalled user growth, especially in the wake of growing competition from Facebook, but an inability to build out successful advertising options is a far larger problem, stoppering revenue potential.

Marketers who covet Snapchat for its youth-centric audience and continue to make huge ad buys on the platform might be disappointed to hear that many of those young users are not just indifferent to their efforts but actively hate them. These findings suggest that, while some of the burden might be on Snapchat's shoulders to build out its marketing offerings, brands also need to get more creative and innovative in how they present themselves on the app.